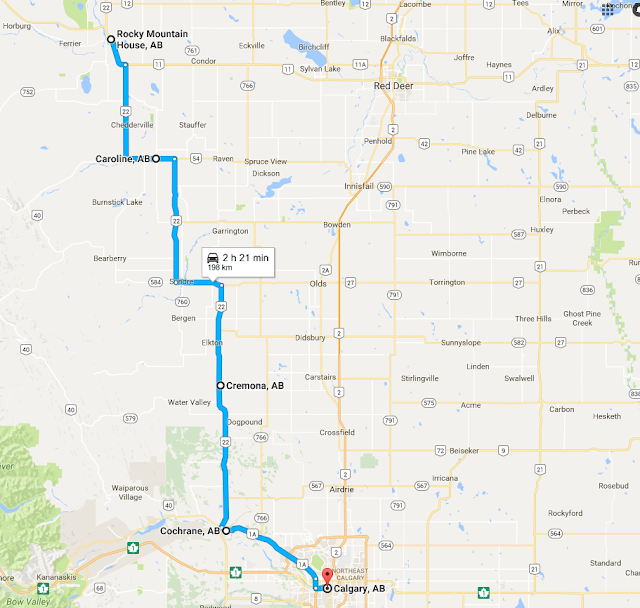

Do you remember the Calgary flood in 2013? I sure do, partly because I live in the inner city and was pretty much completely surrounded by flooded areas or because members of my family were flooded out of their condo and couldn't return for many months. However, the reason the flood is mentioned here is because I work for an insurance brokerage and our business was greatly impacted by the flood waters. The office for BlueCircle was located in the heart of one of the worst hit areas and we were forced off the premises for about a month. One of the reasons we managed well is because we had a contingency plan, whereby we set up shop in an alternate location and carried on with business as usual, as strained and stretched as it may have been. We literally and figuratively were able to keep our heads above water for this extended period of time, finally getting back into our offices after the big cleanup.

|

| Our office is located in the middle, far right corner of this photo and flooded up to the first floor. |

To get your contingency plan in order, here are some tips from one of our premiere insurance providers, Intact Insurance. Always work on a 'worst case scenario', as it is easier to scale back your response if the issues are less severe than you have in your plan.

-Consider all the risks possible: No matter how extreme, think of whatever events are a possibility, such as fire, flood, earthquake, overland water, lightning strike or storm, theft or burglary, building collapse, environmental issues and pollution, computer failure, product recall etc.

-Start with what you consider the highest risk and work your way down. Each risk will have similar issues, but some will be very specific to the event and you will need additional steps in your plan.

-Estimate the time required to deal with each event: Of course, this is a difficult process and will depend on multiple factors. Think of compounding factors, such as seasonal influences or other businesses that may also be factors, such as suppliers or support companies.

-Pre-arrange when possible: Having agreements in place before an event is always a better position than scrambling to get things done after the fact. dealing with trusted and reputable companies will help avoid issues, including exorbitant costs.

|

| Maybe you'll need a temporary office, like this portable unit! |

-Analyze the potential business interruption: Consider things like your customer loyalty base, how long of an interruption you could withstand, your need to be open at all costs, and your competitors advantage while you may be out of commission. Also, what contractual obligations you have that may affect the need to relocate or take other immediate measures.

-Identify resource requirements: What do you need to conduct business on a daily basis, such as process equipment, computers, phones and phone service, tools and equipment, vehicles, raw material, etc. Again, making arrangements for these types of items in advance will make life easier if something does happen. Having names and contacts for all relevant suppliers for these items will give you quick access and help you determine other needs i.e. no immediate supply of raw materials would preclude needing a temporary facility to build your product

-Specify a person in charge of executing the contingency plan: Someone needs to be the leader and they may need help, plus consider the possibility that this person may be directly (physically ) affected by the disaster itself and there should be a succession chart, with everyone understanding what needs to be done.

-

Take an inventory within your business premises: Much like what is recommended for your home and it's contents, having a catalog of all the equipment and items in your office or shop will help you in multiple ways. It can help you identify what your require for your daily operations and will also make the claims process easier and faster.

-Compile a list of people to notify: Who would you need to call to notify of a catastrophic event or disaster. Suppliers who would have to stop deliveries, the postal service to reroute mail, and, of course, employees, who may try to show up to work.Also, you'll need to get that claim going with your insurance company, so have a list of phone numbers, e-mail addresses and your policy number(s) for quick reference. Also, have a basic template made up for the notification, which can be edited according to the event and it's duration.

|

| Your business can be greatly affected by an event like a fire, even if that fire isn't on your premises |

-Keep all documents, or copies of them, off site. Your list of contacts for notification, and your other business documents, like banking info and account numbers, are not going to do much good if they're in a building that isn't accessible or has been destroyed.

-Revise your plan regularly. A business will grow and things change constantly, so review and revise your plan regularly. While you're at it, adjust your inventory of assets, which also changes rapidly. .

Nobody wants a disaster or catastrophe, but the firm who has planned

for one, put its plan into writing and organizes itself for automatic

action after the event, will have a far greater chance of survival and a

successful return to business than the firm without a plan. Being prepared and communicating your contingency plan to everyone in the case of an event will avoid delays or gaps in the information delivered and avoid damaging rumors,

It's great to know that the financial cost of property damage and business interruption can be offset with adequate insurance coverage. Having a Plan 'B' will offset non-economic business opportunity related costs, such as loss of market share, since no product or service is indispensable or irreplaceable ( if one company can provide it, others can too) Of course, this tip sheet is for informational purposes only and you should consult your broker to discuss our insurance coverage so you are well aware of your specific contract(s).

|

| Your business needs to be operating until a rebuild is done |